3 Easy Ways to Build Up Your Savings Account

Your savings account is an important part of your future. Whether you are saving for a large purchase like a home or a car, saving for a wedding, college or retirement, your savings account will have to maintain a steady flow of cash to boost your goals along.

There are several ways to build up your savings account. You first have to start by opening an account at any reputable bank in the UAE, like FAB Bank in Abu Dhabi, Emirates NBD in Dubai. Once you’ve done that, the rest is a matter of strategy.

Make a Budget Plan

Before you can start saving, you’ll have to establish a budget plan and stick to it. This will allow you to know exactly how much money you have available to spend or save after your living expenses have been factored in.

How to Make a Budget

At the end of each month jot down all of your expected bills for the next month. This includes your:

- Phone bills

- Utilities

- Credit card and loan payments

- Medical and Car Insurance

- Car payments

- Rent

- Expected grocery expenses

- Travel expenses

- And meals

Subtract these expenses from your beginning balance at the start of each month. If you get multiple payments per month, like weekly or bi-weekly payments, stager your subtractions (bills) and additions (salary payments) in accordance. What is left is your available balance for savings.

Ideally, you should save 75 percent of this. A modern rule is to save 10-15% of every salary payment you receive.

Invest in Stocks and CDs

You can also invest some of your savings into CD accounts that will increase your initial deposit over a 6-12 month period. The idea of investment is to maintain the value of your money and/or increase its value during inflation.

Investing in stocks may also result in an increase in your initial investment over time, but be responsible and work with a broker to minimize risk. Place the returns of these investments in your savings account and re-invest.

Plan to Save $1,000 in 1 Year (3,272 AED)

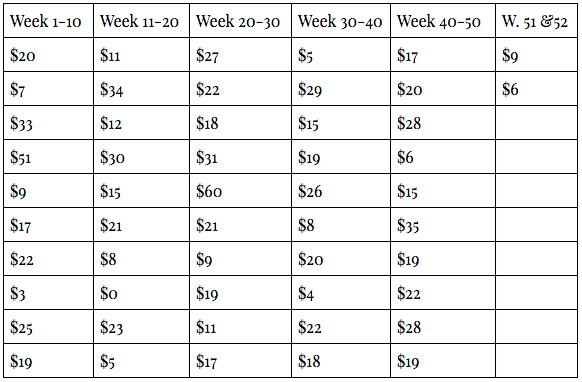

Finally, here’s an actionable plan to save $1,000 in one year. It will require you to make weekly savings deposit of different amounts. The largest deposit you’ll ever have to make is for $60.

There are 52-weeks in a year, each week, save the following amounts:

Once you’ve saved the last deposit, you’ll have saved $1,000 in one year without making major sacrifices or breaking the bank. Keep doing this each year to build up your savings account and this can be your primary savings method for large purchases and vacations. You should also try to do this in addition to the budgeting plan mentioned above. This way, you’ll be saving for the future in general and for short-term purchases.